do I Have Unclaimed Money In Illinois

Home

You found the complete source for complete information and resources for do I Have Unclaimed Money In Illinois on the Internet.

The point is you can always find your missing money for free. “Well I think people felt the process was pretty onerous,” said Treasurer Dave Young. Talk about how much their monthly income is and where it comes from (such as a pension or investments), in addition to what their monthly expenses and debts are (such as their mortgage, car payments and credit cards). 2019S FILE DIFFICULT PERSON. Florida's chief financial officer announced this month that the state had received 61,271 new unclaimed property accounts worth more than $25 million as part of a settlement with insurance company AIG (AIG). The report was attached to a rules proposal now before the judiciary's Advisory Committee on Bankruptcy Rules submitted on Wednesday by the panel's chair, Dana McWay, the clerk of court for the U.S.

The U.S. Department of the Treasury has a Financial Management Service website that provides information about unclaimed federal assets. There are even scholarships for those who have got natural red hair! Let’s assume for a minute that you left your first employer at age 30 and left behind your pension fund with €25,000 in it.

The search is free. The program also dropped the requirement that every claim for an uncashed check or missing security deposit be notarized.

The Ohio Department of Commerce currently holds more than 2.7 million accounts worth over $350 million. This is in accordance to the definition under Section 8 of the Unclaimed Moneys Act 1965. Hour Division (WHD) is holding your back wages. You may want to offer assistance to the most verbal and dirty of local competitors by way of marketing collateral that pursues the customer base of your competitor. For those not watching the CFL game with the crazy 50/50 draw, the TV analyst just pulled his ticket from his pocket on air. Rhode Island, for example, started automatically issuing checks to the owners of unclaimed property in 2017 after its Treasurer Seth Magaziner asked his state legislature to change the law.

It could be an energy bill refund that was sent to the wrong address, a forgotten-about CD, or an inheritance you were unaware you had. “The promise of helping our customers live healthier, longer, better lives includes making sure these hard-earned benefits get to the intended recipients. The state has no time limit for filing claims.

Also among those listings were the names of Greater Columbus businesses, hospitals, fire departments, city governments, school districts and even fellow state agencies. Getting the money will take some extra work, since the IRS requires people to file a paper tax return for 2018 to get their unclaimed refunds.

More Information Around do I Have Unclaimed Money In Illinois

He said the state is hiding $50 million in cash. In Maine, State Treasurer Terry Hayes said her office last month received seven calls within a week from residents who had gotten email solicitations with an embedded link to a phony website. For more information on claiming a 2018 refund, see Claim Your 2018 Tax Refund Now - Or Lose It Forever. Or maybe, they just lost touch with their agent over the years.

► IRS tax refunds and stimulus payments IRS refund checks worth $1.5 billion have gone undelivered or uncashed, often due to name and address changes after marriage or divorce. “Our focus is on getting every student every penny of financial assistance that that we can,” Simpkins said.

The Division of Unclaimed Property is responsible for holding onto and facilitating the return of money or valuables Floridians might have forgotten about, such as old bank accounts or abandoned safe deposit boxes. I thought, ‘that can’t be possible,'” said Pastor Griffith. For New Haven residents with an income of less than 80 percent of the AMI who can prove verifiable income disruption due to the pandemic - whether it be through job loss, closures of businesses or reduction in hours - CASTLE offers to provide both renter and homeownership assistance. We brought back $75 million from one life insurance company.

Louisiana State Treasury’s Unclaimed Property Program returns money, securities, stocks, and bonds to people and businesses across the state. WHERE TO LOOK: If you’re a homeowner in Cook County, Pappas’ office has a search tool where you can check to see if you have a refund coming your way. Computers will be available for those without one, including navigational help from staff for residents that may not know how to use one.

Much more Resources For do I Have Unclaimed Money In Illinois

Businesses, nonprofit organizations and other groups can also have unclaimed property, as there are more than 1.7 million names of individuals and businesses for whom property is available listed on the division’s website. A savings bond is owned by the person who bought it, although you can buy it for someone else. In a state like California, the average amount returned to an individual is $201.12, and in New York state it’s $704.85!

Pay your tax bill by the April 18 tax filing deadline. This is true even if a check or money order specifies a ‘void-after’ date. In certain cases it can be less than 5 years.

Under Probate Code 11850, monies are held for one year then, if not claimed, are escheated to the State. Dozens of Canadians say they’ve discovered uncashed cheques ranging anywhere from a few dollars to over $10,000 after a Tweet by user @3rdPeriodSuits went viral late last week. In addition to advertising the program and directing people to the website, Ohio also licenses finders who can obtain information from the unclaimed property database and reach out to people themselves offering to help them access the money. Guides can even include search terms that don't have their own SeRP yet. Each state has its own laws, rules, and regulations, but if you are owed money by an individual or business that has gone bankrupt, there are steps to take to recover your money. Only the legislature can change the law.

Here are Some Even more Details on do I Have Unclaimed Money In Illinois

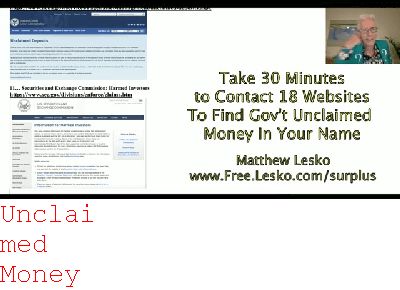

As you begin, be sure anyone who should be part of the conversation is involved, including any siblings you have. The fact that so few people know they’re owed money is a big problem for State Treasurer Mike Pellicciotti. So instead of having to search dozens of government sites to find your money - you can search all these records from one location on our site.

Unclaimed property is primarily an intangible property liability that has been inactive on the books of an entity for a period of time (dormancy period), and for which there has been no owner generated activity. Since most government agencies don’t call people about missing money, I would assume most people would and should be skeptical of these calls. Establishing a payable on death (POD) account or a trust may also need to be part of your financial plan. Taxpayers are able to electronically file their tax returns for 2019 and later. “If the property was dormant for three years it ends up at treasury,” Garrity said. And now, you may even get more money: The State of Illinois is now required to pay interest on much of its unclaimed property, depending on when someone claims it and when it was turned over to the state. Especially skilled PTGs can move up to the next level. State Treasurer Beth Pearce is again urging Vermonters to check the 'unclaimed funds' database, now flush with almost $100 million in cash from all kinds of sources in and outside of the state.

People were asked to fill in their personal information and credit card number, which would be charged up to $2,300 so they could have their unclaimed property returned. If you live in North Carolina, you might want to check your name for missing money. Use Form 1040-ES to calculate. You should also search under your business’ name as well. But then, we all know that it is not going to be there forever, and in fact is getting better now. Similar to Kentucky, only the owner or heir can claim unclaimed property and will be required to provide documentation and proof that the address listed for the unclaimed property is their current or former address.

The U.S. Courts, as custodians of these funds, have established policies and procedures for holding, safeguarding, and accounting for these funds. “I pull out this dollar bill, and she’s like, ‘That’s where it is,’” Gardelli chuckled.

Copies of old bills (such as a utility bill), tax returns, school records, birth or death certificates, or credit reports will suffice. When you search for a term like "Hawaii," for example, you'll see that links are organized into subcategories. Unclaimed Funds are funds held by the Treasurer’s Office for an owner who is entitled to the money, but who has failed to claim ownership of it. How does someone prove they can make a claim? Finding unclaimed money from deceased relatives may require a little detective work, but it can be easier than you might think. To claim the stimulus cash on your tax return, look for line 30 on the Form 1040 for 2021, labeled Recovery Rebate Credit.

property, money, state, claim, search, government, owner, states, office, service, address, claims, form, treasury, find, funds, department, refund, program, name, business, checks, forms, treasurer, security, report, resources, division, bureau, estate, certificate, tax, check, phone, payment, businesses, owners, agencies, site, services,unclaimed property, unclaimed money, unclaimed property division, unclaimed property program, short certificate, national association, claim forms, unclaimed funds, state treasurer, deceased owner, tangible property, fiscal service, federal tax refund, unclaimed property search, google translate™, personal representative, security deposits, social security number, state treasurers, rightful owners, interactive map, official government, multiple states, unclaimed property administrators, rightful owner, new york state, pa. c.s.a, wills office, pennsylvania treasury, unclaimed assets,unclaimed property, pennsylvania, google, decedent, refund division

Previous Next

Other Resources.related with do I Have Unclaimed Money In Illinois:

unclaimed Money Wyoming

massachusetts Unclaimed Money

list Of Unclaimed Money In Minnesota

unclaimed Money In Nevada

unclaimed Money Seattle Washington